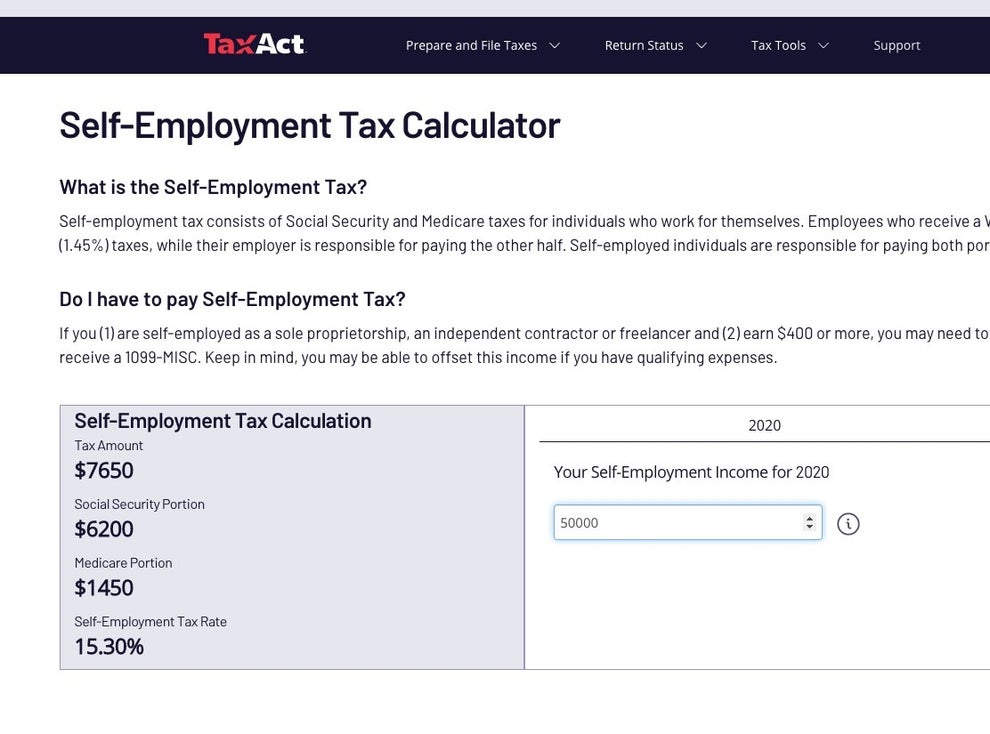

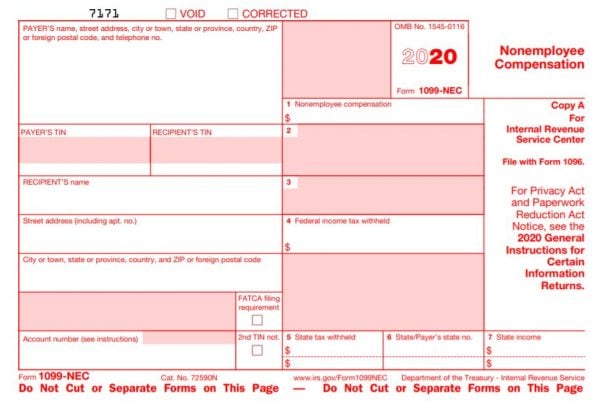

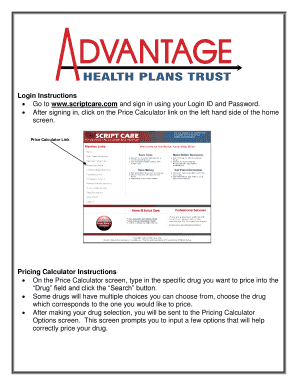

Public policy in California has long favored the full and prompt payment of wages due an employee To ensure that employers comply with the laws governing the payment of wages when an employment relationship ends, the Legislature enacted Labor Code Section 3 which provides for the assessment of a penalty against the employer when there is a willful failure to pay wages dueInformation returns (1099) New for 21 tax year 1099K, third party network transactions An information return is a tax document that banks, financial institutions, and other payers send to the IRS to report payments paid to a nonemployee during aWith Social Security at 124% and Medicare at 29%, SelfEmployment is a major cost of 153% (right off the top, before there's any income taxes paid) This tax calculator shows these values at the top of your results If you're new to personal taxes 153% sounds like

Tax Calculators Estimator By Tax Years Estimate Refund

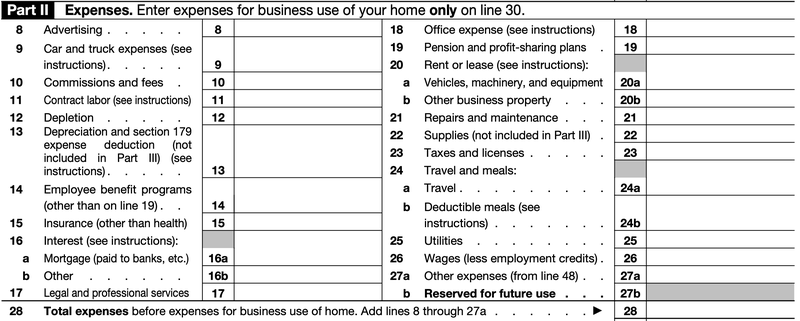

1099 paycheck calculator california

1099 paycheck calculator california- If you're a 1099 worker (or a small business that employs 1099 workers) seeking a Paycheck Protection Program (PPP) loan, you likely have questions about whether or not you qualify for a PPP loan, what you need to apply, and how potential loan forgiveness will work We've put together some of the most common questions we've received surrounding PPP and 1099 Use the form to calculate your gross income on Schedule C Outside of the 1099MISC, you may need to file your estimated taxes quarterly if you will pay more than $1,000 in taxes for the fiscal year All 1099 employees pay a 153% selfemployment tax There are two parts to this tax 124% goes to Social Security and 29% goes to Medicare

California Income Tax Calculator Smartasset

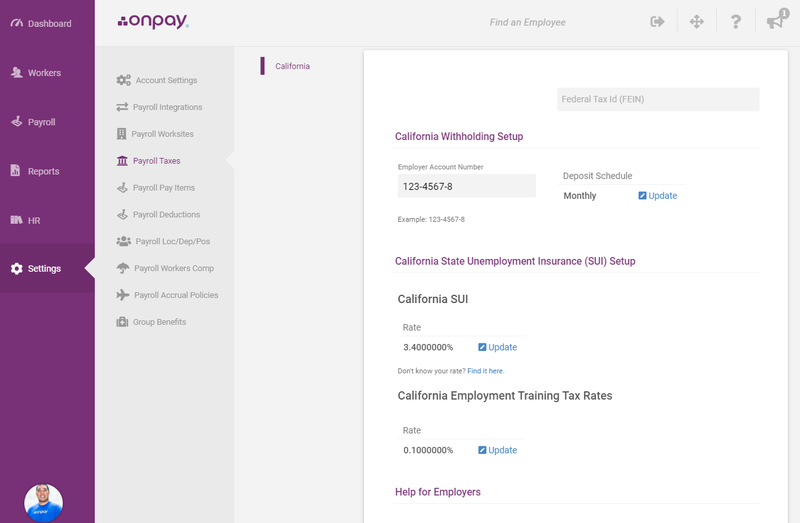

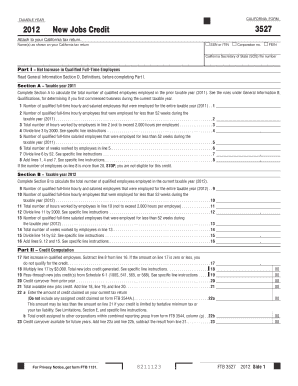

For tax year 10 the following California Payroll Taxes are in effect 10 PIT Withholding – California provides two methods for determining the amount to be withheld from wages and salaries for state personal income tax Method A – Wage Bracket Table Method and Method B – Exact Calculation Method California has among the highest taxes in the nation Its base sales tax rate of 725% is higher than that of any other state, and its top marginal income tax rate of 133% is the highest state income tax rate in the countryIf you make $55,000 a year living in the region of California, USA, you will be taxed $12,070 That means that your net pay will be $42,930 per year, or $3,577 per month Your average tax rate is 2% and your marginal tax rate is 397% This marginal tax rate means that your immediate additional income will be taxed at this rate

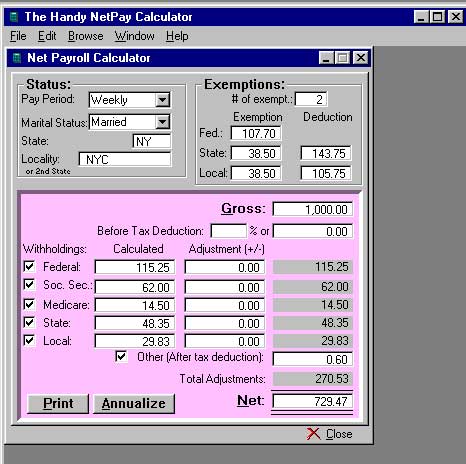

California Payroll Taxes New State Law, Mandatory efile of Payroll Taxes and Reports Employers in California are required to electronically submit employment tax returns, wage reports, and payroll tax deposits to the Employment Development Department This rule went into effect onOne which calculates payroll based upon regular and overtime hours worked, as well as sick leave and vacation;Use Gusto's salary paycheck calculator to determine withholdings and calculate takehome pay for your salaried employees in California We'll do the math for you—all you need to do is enter the applicable information on salary, federal and state W4s, deductions, and benefits

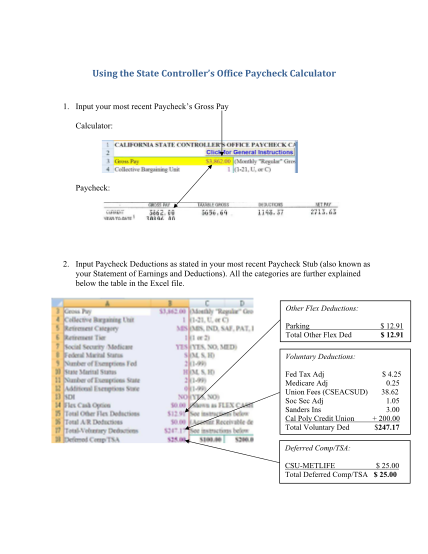

Multiply the hourly wage by the number of hours worked per week Then, multiply that number by the total number of weeks in a year (52) For example, if an employee makes $25 per hour and works 40 hours per week, the annual salary is 25 x 40 x 52 = $52,000 Important Note on the Hourly Paycheck Calculator The calculator on this page is CDTFA public counters are now open for scheduling of inperson, video, or phone appointments Please contact the local office nearest you For questions about filing, extensions, tax relief, and more call Online videos and Live Webinars are available in lieu of inperson classes Businesses impacted by the pandemic, please visit our COVID19 pageFree payroll tax, paycheck calculator, print paychecks & paystubs eSmartPayroll – IRS, SSA and States authorized payroll forms W2, W2c, 1099misc, correction, 941, 940 and State forms, including converting ICESA, MMREF files to XML for California EDD form DE9C and others

Salary Paycheck Calculator Calculate Net Income Adp

Paycheck Calculator Apo Bookkeeping

Pursuant to California Labor Code Section 226(a), employers are required to provide employees with a paystub or itemized wage statement Read more Categories Payroll s California Pay Stub Requirements , California Paystub RulesYou need in order to remain operational within an area For example, if you want to enter the market of Santa Monica, California, you will have to pay $75 annually as well as a percentage of all revenues above $60,000 This is due to the fact that you are allowed to work in a booming region thatRecently in 14, the Ninth US Circuit court of Appeals in San Francisco ruled that the drivers of Fed Ex in California are employees With the online paycheck calculator software, you can Calculate paychecks and prepare payroll any time;

Free Paycheck Calculator Hourly Salary Usa Dremployee

1099 Taxes Calculator Estimate Your Self Employment Taxes

It's a fullfeatured paycheck calculator that allows for hourly or salaried, bonus, 401k and other earnings and deductions Users can also download and print paychecks, all for FREE!Use this SelfEmployment Tax Calculator to estimate your tax bill or refund This tool uses the latest information provided by the IRS including annual changes and those due to tax reform Gather your tax documents including 1099s, business receipts, bank records, invoice payments, and related documents to fill in the drop down sections 1099 Contractors and Freelancers Most sharing economy workers are 1099 contractors for tax purposes These individuals are also interchangeably referred to as independent contractors or freelancers The IRS taxes 1099 contractors as selfemployed And, if you made more than $400, you need to pay selfemployment tax

Bonus Tax Calculator How To Calculate Bonus Paychecks The Turbotax Blog

Start The Paycheck Calculator And W 4 Form Creator In 22

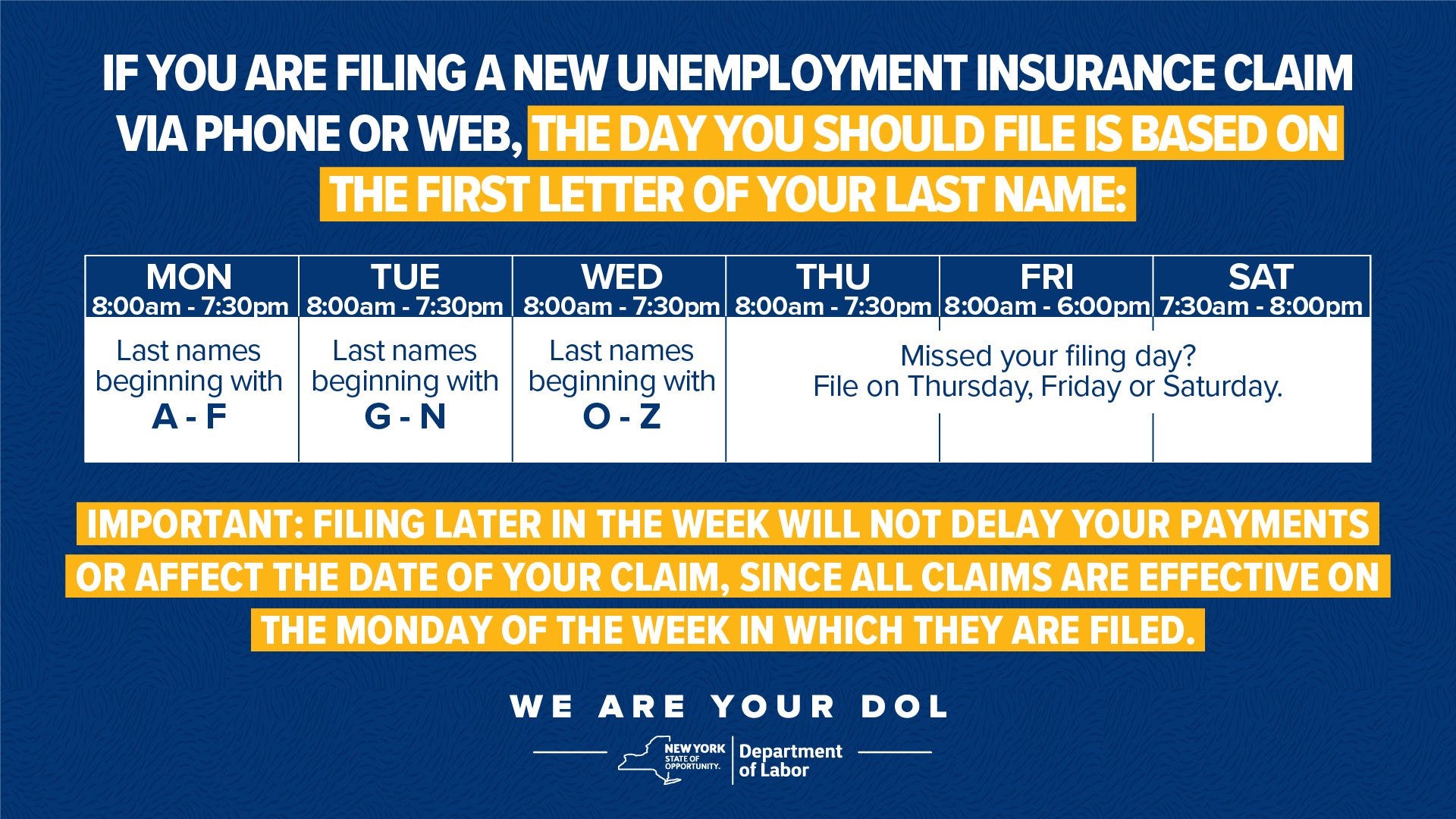

After entering it into the calculator, it will perform the following calculations Federal Tax Filing $130, of earnings will result in $22,900 of that amount being taxed as federal tax FICA (Social Security and Medicare) Filing $130, of earnings will result in $9, being taxed for FICA purposes California State TaxThe information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only It is not a substitute for the advice of an accountant or other tax professional The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any timeThe unemployment benefit calculator will provide you with an estimate of your weekly benefit amount, which can range from $40 to $450 per week Once you submit your application, we will verify your eligibility and wage information to determine your weekly benefit amount

1

Here S How Much Money You Take Home From A 75 000 Salary

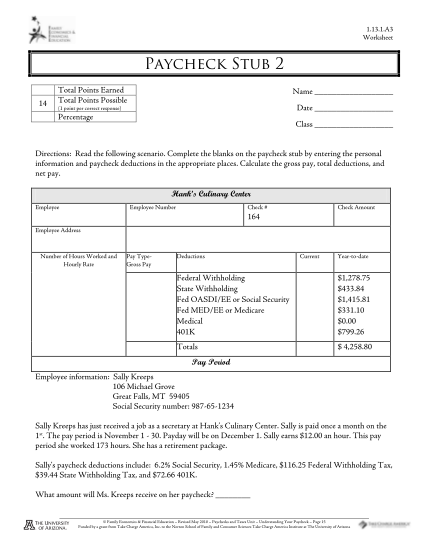

The Salary Paycheck Calculator Important Information The calculator that is provided on this web site is only meant to provide general guidance and estimates about the payroll process It should not be relied upon to calculate exact taxes, payroll or other financial dataEmployee payroll calculator Use this employee payroll template to record your employee payroll and calculate hourly paychecks Three worksheets are included one for employee wage and tax information; Step 1 Calculate net earnings Gross earnings business expenses = net earnings Step 2 Calculate the amount that equals 9235% of your net earnings, which is the amount subject to selfemployment tax Net earnings X 9235% = the amount subject to selfemployment tax Step 3 Calculate the Social Security portion of selfemployment tax

Money Management Lessons For Self Employed People

1

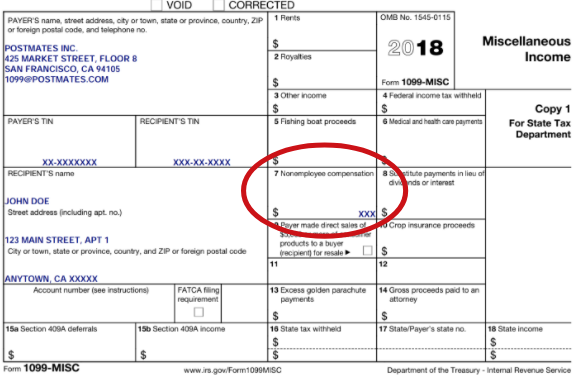

As an independent contractor that makes more than $600, you'll be given a 1099MISC to file If you worked for a company, your employer typically takes money out from your paycheck to set aside for your taxes owed As a 1099 worker, you are solely responsible for handling your taxes (use our 1099 calculator to see how much you owe) A lot of independent contractors are notThe calculator below will help you compare the most relevant parts of W2 vs 1099 by looking at how the two options affect your income and tax situation, but it's important to note that this is not an exact calculation of your taxes because many other factors outside the scope of this comparison can affect your tax situationYou made $400 in selfemployed/1099 income For the full details, check out the IRS's clarification "Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed" While the annual return is due on Tax Day (April 15th), quarterly tax payments are due every quarter Make sure to pay

/Clipboard01-779726998cf64e9085a5319a27cc25f4.jpg)

W 2 Form Overview Line By Line Guide To Form W 2

How Does A Nanny File Taxes As An Independent Contractor

And a third which creates pay stubsPaycheck Calculator, Payroll Tax Software, W2 & 1099 Management and Efile Services PaycheckManager – Free paycheck, payroll tax calculator, print paychecks & pay stubs Innovative, flexible, patented online payroll management softwareOur California Salary Tax Calculator has only one goal, to provide you with a transparent financial situation By seeing how all of your taxes are split up and where each of them go, you have a better understanding of why you pay the tax you do, where the money goes, and

How Starting An S Corp Could Lower Your Taxes By 5 000 Tax Savings Calculator Gusto

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Paying Taxes On Your SelfEmployment Income The biggest reason why filing a 1099MISC can catch people off guard is because of the 153% selfemployment tax The 1099 tax rate consists of two parts 124% for social security tax and 29% for Medicare The selfemployment tax applies evenly to everyone, regardless of your income bracketThis calculator provides an estimate of the SelfEmployment tax (Social Security and Medicare), and does not include income tax on the profits that your business made and any other income For a more robust calculation, please use QuickBooks SelfEmployed If you receive a Form 1099, you may owe selfemployment taxes to the IRSThe following table compares the tax liability for a W‐2 employee and a 1099 contractor/self‐employed individual with relatively low business expenses, married with two children, using the tax rate schedules provided by the IRS 1099 W2 1099 W2 1099 W2 1099 W2 1099

The Definitive Guide To Paying Taxes As A Real Estate Agent Aceableagent

Free Self Employed Tax Calculator View Your Potential Tax Obligation Instantly Hurdlr

Income Tax Calculator Knowing how much you need to save for selfemployment taxes shouldn't be rocket science Our calculator preserves sanity, saves time, and destresses selfemployment taxes in exchange for your email10 Need to adjust both your federal and state withholding allowances, go to the Internal Revenue Service (IRS) website and get Form W4, Employee's Withholding Allowance Certificate 11 After you determine the forms needed Use the calculators to determine the number of allowances you should claim Complete the forms and give them to yourTakeHomePaycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary It can also be used to help fill steps 3 and 4 of a W4 form This calculator is intended for use by US residents The calculation is based on the 21 tax brackets and the new W4, which, in

California Income Tax Calculator Smartasset

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors It can also be used to estimate income tax for the coming year for 1040ES filing, planning ahead, or comparison Explore many more calculators on tax, finance, math, fitness, health, and moreWhen calculating your takehome pay, the first thing to come out of your earnings are FICA taxes for Social Security and Medicare Your employer withholds a 62% Social Security tax and a 145% Medicare tax from your earnings after each pay period If you earn over $0,000, you'll also pay a 09% Medicare surtax When is 1099MISC form required?

Gppccee9qn2qam

What Is Casdi Employer Guide To California State Disability Insurance Gusto

The California self employment tax is divided into two different calculations The first is the 124% Social Security amount that is paid on a set amount, which in will be the first $137,700 of your net earnings The second payment to Medicare is 29%, applied against all your combined net earnings There are some variations if your spouseCalifornia Salary Paycheck Calculator Change state Calculate your California net pay or take home pay by entering your perperiod or annual salary along with the pertinent federal, state, and local W4 information into this free California paycheck calculator See FAQs below State & DateCalifornia Hourly Paycheck Calculator Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information This California hourly paycheck calculator is perfect for those who are paid on an hourly basis See FAQs below California

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Manager Blog Online Payroll Tax Calculator Software

The salary paycheck calculator can help you estimate FLSAexempt salaried employees' net pay "Exempt" means the employee does not receive overtime pay To try it out, enter the employee's name and location into our free online payroll calculator and select the salary pay type option Then enter the employee's gross salary amountYou are required to file a Nonemployee Compensation Form (1099NEC) or a Miscellaneous Information Form (1099MISC) for the services performed by the independent contractor You pay the independent contractor $600 or more or enter into a contract for $600 or more The independent contractor is an individual or sole proprietorshipHow to calculate annual income To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000

Tax Calculators Estimator By Tax Years Estimate Refund

Free Tax Calculator Tax Return Estimator Liberty Tax

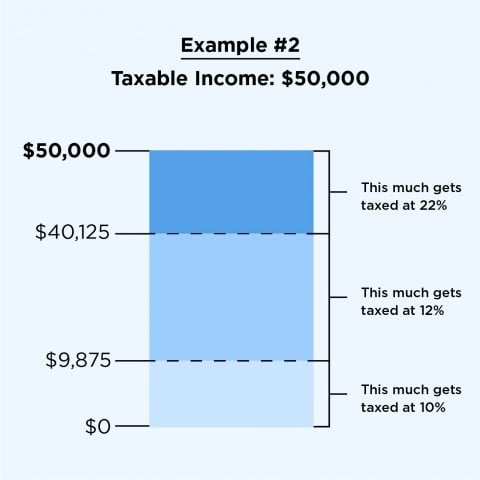

Esmart Paycheck Calculator Free Payroll Tax Calculator California Payroll Tax Breaking Down The Basics Squar Milner How To Report And Pay Taxes On 1099 Income California Paycheck Calculator Smartasset 0wa6fipq63ulbm 17 Tax Brackets How To Figure Out Your Tax Rate And BracketYou will pay an additional 09% Medicare tax on the amount that your annual income exceeds $0,000 for single filers, $250,000 for married filing jointly, and $125,000 married filing separate Use this calculator to estimate your selfemployment taxes This information may help you analyze your financial needs21 Posts Related to Free Pay Stub Template For 1099 Employee 1099 Employee 1099 Pay Stub Template Pdf Pay Stub Template For 1099 EmployeeCreating a budget is a responsible decision By calculating your paycheck, you can determine the amount of money you will have and designate it to specific bills and savings Calculating your paycheck requires the knowledge of your

Esmart Paycheck Calculator Free Payroll Tax Calculator 21

California Payroll Tax Problems Orange County Tax Attorney

Start Now eSmartPaycheck Online Payroll Management eSmartPaycheck is an easy, complete and flexible online payroll management tool that enables users to Create and print paychecks & paystubs anytime for any employee Automatically calculate Federal & State payroll How much taxes will you pay on 1099 earnings?

3

Postmates 1099 Taxes And Write Offs Stride Blog

California Income Tax Calculator Smartasset

Paybreeze Paycheck Calculator W4 401 K Payroll Taxes Paycheck What Ifs

How To Calculate Taxable Wages A 21 Guide The Blueprint

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

California Income Tax Calculator

California Income Tax Calculator

15 Paycheck Calculator Free To Edit Download Print Cocodoc

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Tax Calculator And Refund Estimator 21 Turbotax Official

Salary Paycheck Calculator Calculate Net Income Adp

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

California Income Tax Calculator

Free Payroll Tax Paycheck Calculator Youtube

Doordash 1099 Taxes And Write Offs Stride Blog

Llc Tax Calculator Definitive Small Business Tax Estimator

W 2 1099 Filer Software Net Pr Calculator

Payroll Software Solution For California Small Business

Part 2 Salary Vs Actual Pay An Actual Paycheck In California Fashionfoodiela

California Income Tax Calculator

Paycheck Calculator Template Download Printable Pdf Templateroller

A 21 Guide To Taxes For Independent Contractors The Blueprint

Estimated Tax Payments For Independent Contractors A Complete Guide

Paycheck Calculator Take Home Pay Calculator

Fha Loan With 1099 Income Fha Lenders

Paycheck Calculator Take Home Pay Calculator

Washington Paycheck Calculator Smartasset

17 Personal Income Tax Booklet 540 Ftb Ca Gov

Here S How Much Money You Take Home From A 75 000 Salary

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

Self Employment Tax Calculator Estimate Your 1099 Taxes

California Income Tax Calculator

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

21 Federal Income Tax Brackets Tax Rates Nerdwallet

What Are Employee And Employer Payroll Taxes Ask Gusto

Tax Calculator Estimate Your Income Tax For And 21 Free

1099 Taxes Calculator Estimate Your Self Employment Taxes

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

The True Cost To Hire An Employee In California Infographic

Beware Of The Unemployment Benefit Tax Bite What You Need To Know

17 Paycheck Tax Calculator Free To Edit Download Print Cocodoc

/payroll-taxes-3193126-FINAL-ef94c8b30eda48fdbde6ab58d9a30d49.png)

Payroll Taxes And Employer Responsibilities

Quarterly Tax Calculator Calculate Estimated Taxes

California And New Jersey Hsa Tax Return Special Considerations

16 Printable Income Tax Calculator California Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

.gif)

1099 Taxes Calculator Estimate Your Self Employment Taxes

California Paycheck Calculator Smartasset

1099 Workers Vs W 2 Employees In California A Legal Guide 21

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

California Income Tax Calculator

Form 1099 Nec For Nonemployee Compensation H R Block

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Free Tax Estimate Excel Spreadsheet For 19 21 Download

California Income Tax Calculator Smartasset

Free Paycheck Calculator Hourly Salary Usa Dremployee

16 Amazing 1099 Independent Contractor Tax Deductions Updated 21

California Salary Paycheck Calculator Paycheckcity

What Type Of Income Is Counted For Covered California Aca Plans

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Esmart Paycheck Calculator Free Payroll Tax Calculator 21

1099 Workers Vs W 2 Employees In California A Legal Guide 21

17 Personal Income Tax Booklet 540 Ftb Ca Gov

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

16 Printable Income Tax Calculator California Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

16 Printable Income Tax Calculator California Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Payroll Software Solution For California Small Business

Paycheck Calculator Take Home Pay Calculator

Are Workers Compensation Benefits Taxable In California Workers Compensation Attorney

California Self Employment Tax Calculator 21

Free Tax Calculator Tax Return Estimator Liberty Tax

Free Tax Calculator Tax Return Estimator Liberty Tax

Free Tax Estimate Excel Spreadsheet For 19 21 Download

Federal Income Tax Calculator Credit Karma

Gross Pay

Esmart Paycheck Calculator Free Payroll Tax Calculator 21

Employer Payroll Tax Calculator Gusto

0 件のコメント:

コメントを投稿